how to learn in it

How to Develop the Best Interview Questions in 7 Simple Steps

You may not understand the importance of good interview questions until you realize that you hired someone that is not …

How to Develop the Best Interview Questions in 7 Simple Steps Read More »

The post How to Develop the Best Interview Questions in 7 Simple Steps appeared first on .

How can I create an automatic numerical progression in HTML …?

HI!!

How can I create an automatic numerical progression from 0 to 500,000 in html?

The code I was given is this:

<p><span style="font-family: Calibri, sans-serif;"><span style="text-shadow: rgba(255, 255, 255, 0.8) 0px 3px 2px;"><sup>437</sup></span></span></p>

how can i make the code progressive and automatic every three minutes?

The progression I have to make it for the university I am still a beginner. Help me !!! Thanks for the reply :)

How to Do Payroll in 5 Simple Steps

Want to just get started? Click here to sign up for Gusto and start doing payroll today.

Running payroll can be a challenge. Between federal income tax, state income tax, Social Security, and other payroll deductions, there are lots of things to keep track of.

You need to make sure that payroll is set up and processed accurately to remain compliant with the law. Beyond compliance, accurately processing payroll keeps your employees happy.

Fortunately, there are tools out there that take the guesswork out of the payroll process.

Top Online Payroll Services to Do Payroll

If you want to do payroll, you’ll need a payroll service. Here’s the best options

- Gusto — The best for dispersed workforces

- Paychex — The best for experienced payroll teams

- OnPay — The best for simplifying all things payroll

- QuickBooks Payroll — The best for solopreneurs and small teams

- ADP — The best for never outgrowing your payroll provider

You can read our full reviews of each online payroll service here.

5 Steps to Do Payroll

This guide will teach you how to set up and run payroll with ease, no matter your experience level.

- Choose your payroll method

- Add your employees

- Choose a payroll schedule

- Calculate gross pay, deductions, and other withholdings

- Run payroll and file reports

The Easy Parts of Doing Payroll

Believe it or not, the easiest part of doing payroll is getting started. Lots of people struggle with this because they think it’s intimidating and don’t know where to begin.

But if you’re using one of the best online payroll services, the process is very straightforward.

Gusto is a great option to consider here. You just need to answer a few simple questions about your business and employees to get started.

Since everything is online, you can set up self-service onboarding for your employees. This really takes a lot of the workload off of your shoulders.

Calculating payroll taxes and filing them with the appropriate government agencies is another task that intimidates business owners. But if you’re using an online payroll service like Gusto, all of this is handled automatically—you won’t have to worry about a thing.

The Difficult Parts of Doing Payroll

Running payroll definitely has its fair share of challenges. The biggest concern is payroll compliance.

If you make mistakes when running payroll, it could lead to some hefty fines, penalties, and potential lawsuits. Underpaying employees, overpaying employees, miscategorizing employees, and miscalculating deductions are just a handful of common payroll mistakes that employers make every day.

Using payroll software helps reduce some of these mistakes, but not all of them. It’s still on you to make sure employees are categorized correctly, whether it be exempt or non-exempt.

Another often overlooked part of running payroll is ensuring sufficient funds to cover all payroll expenses. This is a challenge for startups and small businesses.

You must have enough cash in the bank to pay your employees for each payroll cycle. So if you don’t have lots of working capital or business is slow, you may need to take out a payroll loan to make sure everyone gets paid. This can be costly and spiral out of control if you’re not careful.

Step 1 – Choose Your Payroll Method

First, you need to determine the system you want to use for payroll processing. Generally speaking, there are three main options to choose from—manual, software, and outsourced.

Each of these methods has pros and cons. Using payroll software will be the best option for most businesses. But we’ll take a closer look at each of these systems below so you can determine what works best for your situation.

Manual Payroll Systems

As the name implies, manual payroll processing is done by hand. It’s complicated, time-consuming, and error-prone. Some of you might already be doing payroll this way and recognized the challenges, which is what brought you to this guide in the first place.

Without getting too detail-oriented, here’s the basic concept behind manual payroll systems.

Your staff will fill out time cards or punch the clock for their shifts. Then you need to manually calculate their wages, taxes, and write checks.

For small businesses with just a handful of employees, this might seem like a fast and easy way to get started running payroll. But it’s really not scalable and shouldn’t be used as a long-term solution.

Aside from your time, manual payroll systems are the cheapest option. But it could cost you more in the long run if you’re making errors or have compliance issues. We can’t recommend this option with much confidence.

Payroll Software

Payroll software is a modern and effective way for most businesses to process payroll. These online systems leverage automation, employee self-service, and provide simplicity for everyone.

Online payroll systems allow you to go paperless and offer self-service solutions to your employees. It’s easy for them to update their information in real-time without having to bother you or your HR staff.

Arguably the best part of payroll software is the improved accuracy. It eliminates steps in the payroll process that are prone to errors when done manually.

For example, let’s look at a solution like Gusto. Gusto integrates with accounting systems and time tracking software to ensure all hours worked are paid accurately.

Not only will this save you a ton of time, but it also prevents mistakes that commonly occur when running payroll by hand.

The cool part about using an online payroll tool like Gusto is that it’s an all-in-one platform for HR, employee onboarding, time tracking, employee benefits, and more. So you can get everything you need under one roof instead of using multiple platforms for different features.

Scalability is another huge benefit here. As your business grows, it’s easy to keep adding new employees to your payroll system without any extra work on your end.

Payroll software is more expensive than manual payroll processing, but it’s still very affordable. The fees are easily justifiable when you consider the potential cost of a compliance fine or lawsuit. Gusto starts at just $40 per month plus $6 per employee.

Outsourced Payroll

Outsourcing your payroll process to a third-party professional is another option to consider. This will be the most expensive route, which is why most businesses tend to keep payroll in-house.

On the plus side, outsourced payroll companies are extremely reliable. They’ll handle everything from collecting employee information to tax filings, pay stubs, direct deposit, and beyond. If your staff has a problem or question, they can usually contact the payroll company directly for a resolution.

With that said, outsourced payroll companies don’t technically work for your business. So you don’t have as much control over their services and availability.

For example, if you or your staff has a question on the weekend or after hours, it will likely take a while to get a response. These problems won’t happen with online payroll software—as those platforms are available 24/7 through self-service portals.

Only a small percentage of businesses can truly benefit from an outsourced payroll system. They work well for mid-sized companies that want a dedicated payroll team but don’t have the resources to deploy an in-house department.

Step 2 – Add Your Employees

Regardless of the payroll method you’ve selected in the first step, the next thing you need to do is add your staff to the payroll system.

To do this correctly and remain compliant, you need to get the proper forms filled out for each person being added to your payroll. Employees need to fill out a W-4 and an I-9. If you’re using independent contractors or freelancers, then you need to collect 1099 forms.

This is another reason why it’s so advantageous to use an online payroll system. Rather than distributing these forms and collecting them by hand, you can take care of everything digitally.

Your staff can fill out and manage these forms online and drastically reduce the work required on your end. As you continue to grow and hire new employees, the process remains fast and paperless.

They’ll fill out all the required forms online, add their direct deposit information, and automatically get added to your payroll system.

Step 3 – Choose a Payroll Schedule

According to the Fair Labor Standards Act (FLSA), employers are not restricted from changing paydays. Federal law doesn’t impose any requirements on how frequently you must run payroll either.

With that said, many states have payday laws that must be followed.

For example, California requires most employers to pay employees at least twice within a calendar month. In Utah, employees on an annual salary can be paid once per month.

Check out the state payday requirements from the US Department of Labor for more information about your local mandates. You should also consult with a labor attorney to ensure your payroll schedule is compliant with state and local laws.

Laws and regulations aside, it’s in your best interest to pick a schedule that’s favorable to your employees and stick with it. Even if the law says you’re allowed to delay payroll by days or weeks, your staff won’t be happy about this, and it can create big problems for your business.

Generally speaking, these are the four options that you can choose from:

- Weekly payroll — 52 pay cycles per year

- Bi-weekly payroll — 26 pay cycles per year

- Semi-monthly payroll — 24 pay cycles per year

- Monthly payroll — 12 pay cycles per year

Most businesses tend to go with weekly or bi-weekly schedules.

While you definitely want to stick to the schedule, it’s worth noting that Gusto supports unlimited pay runs. This includes bonuses and off-cycle pay runs. So if something comes up and you want to pay someone between normally scheduled pay periods, you can do so with Gusto—no problem.

Step 4 – Calculate Gross Pay, Deductions, and Other Withholdings

Now comes the hard part of running payroll. Wage calculations, payroll taxes, withholdings, and all of the other numbers that will make your head spin.

Gross pay is fairly simple to calculate. For hourly workers, just multiply their hourly rate by the number of hours they worked during that pay period. Don’t forget about overtime for non-exempt employees.

For staff on a salary, take their annual salary and divide it by the number of pay cycles you’re running in a year. The gross pay of a salaried employee getting paid $78,000 per year on a bi-weekly schedule comes to $3,000 per cycle.

Payroll Taxes

Without getting too specific here, payroll taxes are generally paid by employers and employees alike. There are lots of variables that go into the exact amount of taxes paid. But for the most part, payroll taxes include:

- Federal payroll taxes

- State payroll taxes

- Local taxes

- Social Security taxes

- Medicare

- Workers’ compensation

Things like FUTA (Federal Unemployment Tax) and FICA (Federal Insurance Contribution Act) are just a couple of examples of payroll taxes that must be withheld from employee paychecks.

Trying to calculate these numbers manually is extremely difficult. That’s why we recommend using a payroll service that automatically calculates payroll taxes for you.

Not only does Gusto automatically calculate these taxes for you, but they also file them during each pay cycle.

Other Withholdings

Depending on your business and the employee in question, there are other types of withholdings that need to be factored in here as well.

401(k) contributions, health insurance, and other employee benefits would fall into this category.

Wage garnishments need to be considered too. This occurs when a court orders an employer to withhold a specific amount of an employee’s paycheck for things like consumer debt, student loans, child support, back taxes, alimony, and more.

Step 5 – Run Payroll and File Reports

Now it’s time to actually pay your employees. Take the gross pay calculated in the previous step and subtract all of the taxes and other withholdings. This number is the net pay.

Depending on the payroll system you’re using, the pay can be issued in a variety of ways:

- Live checks

- Direct deposits

- Payroll money cards

Most employees prefer direct deposit, and it makes things easy for you as well. Even if you’re running direct deposit, make sure there’s a pay stub that includes all of the details for the pay period.

Even a digital pay stub will include all of the hours worked, pay rate, deductions, taxes, net pay, and more.

If you’re using an online payroll system like Gusto, it’s easy for your staff to access these records at any time. They can always go back and check to see an old pay stub or see withholdings year to date.

Payroll Filings

In addition to paying employees, employers are also tasked with filing and reporting information to different agencies. Lots of this has to do with the taxes calculated in step #4.

Common federal and state payroll filings include:

- Federal tax deposits — FICA and employee tax withholdings to the IRS.

- State tax filings — State income tax and unemployment taxes (varies by state).

- FUTA tax deposits — Quarterly taxes paid to the IRS for federal unemployment tax.

- Form 941 filings — Employer quarterly federal tax return.

- Form 940 filings — Annual report for FUTA taxes.

Again, if you’re using a comprehensive payroll solution like Gusto, the filing process will be handled automatically.

How can rules this sites?

hello everyone. I am palash

19 Best Monospaced Fonts For Coding & Design

Daily API RoundUp: Carbon Intensity, Pressbooks, GetProspect, Unwrangle

Every day, the ProgrammableWeb team is busy, updating its three primary directories for APIs, clients (language-specific libraries or SDKs for consuming or providing APIs), and source code samples.

Udemy Paid Courses for Free with Certificate

You can get 100% free udemy certificate courses at thepager, they upload free courses every afternoon

click this link to check all free courses https://thepager.in/free-courses/

Apkjim Apk Downloader Free Download APK

For example brain teasers ought to have several games under it like quizzes, puzzles, optical illusions, crosswords, memory games, trivia, and memory games. apk jim Games however should have roulette, black jack,and other games that can be played in the regular live gaming facility. This will ensure you that the website is worthy of time that you invest taking a look at their products, not to mention advertisers.

Com vs Net – What’s the Difference Between Domain Extensions

Have you ever wondered what the difference is between .com vs .net domain name extensions? Choosing the right domain name is crucial because it can have an impact on your branding and search rankings.

In this article, we will explain the difference between .com vs .net domain extensions and which one is better for your website.

What Are .Com and .Net Domain Name Extensions?

A domain name is your website’s address on the internet. Ours is wpbeginner.com.

To learn more about domain names, see our beginner’s guide on what is a domain name and how do domains work.

Domain names always have an extension. This is sometimes also called a TLD, which stands for Top Level Domain. For instance:

example.com

example.net

example.org

You can choose from a wide range of domain extensions when making your website.

Most domain extensions don’t have any restrictions on usage and lots of new domain extensions have been created in recent years.

However, extensions were originally created for different types of websites. They have specific meanings.

You need to choose a domain name extension that fits your business while helping you build a recognizable brand in your industry.

Let’s take a look at the difference between the most popular .com vs .net domain extensions to see which is better for your business.

Difference Between .Com vs .Net Domain Names

Com and Net are two of the most popular domain name extensions. If your preferred .com domain name extension is not available, then you might be tempted to use a .net instead.

However, .net isn’t a good option for your business in most cases.

The “com” in the .com domain name indicates a “commercial” site. This can cover business websites, websites that want to make money online, personal websites, blogs, portfolios, and more.

On the other hand, the “net” in the .net domain name extension stands for “network”. It was designed for the internet, networking, and email service providers.

If you’re wondering about .org, that stands for “organization” and was originally intended for use by nonprofit organizations.

When Should You Choose a .Com Domain Name?

The .com domain extension has been synonymous with the internet since the “dot-com bubble” in the late 1990s. Over 40% of all registered domain names are .com domains.

It’s much easier for people to remember a .com domain name than any other domain extension. It’s familiar and reassuring, plus it makes your site look professional.

Also, most mobile keyboards have a dedicated .com button. You won’t find that for .net (or any other extension).

There’s just one problem. You’ve probably noticed that .com domain names are so popular that it feels like all the good ones are already taken!

However, there are still plenty of clever ways to get the perfect .com domain name. Here are some things to try:

- Check that your domain name represents your business and what you do. For example, stargardeningservices.com is better than starservices.com.

- If your preferred domain name is taken, then you can add a word before or after it to make it unique. Your location could work well here. For example, stargardeninghouston.com.

- Make sure your domain name can be easily pronounced and remembered. Don’t use hyphens or numbers in your domain name.

- Take advantage of online domain name generators. These free tools will help you come up with clever domain name ideas that are unique and still available. WPBeginner now has an AI-powered free business name generator.

Need more help? We’ve got lots of practical tips and real-life examples in our article on how to choose the best domain name for your website.

When You Should Use the .Net Domain Extension?

The .net extension still makes sense in some cases. You could use it if you offer internet, networking, database hosting, email hosting, or similar services.

You might even want to use a .net domain name if it truly suits your brand.

For example, Behance.net is a popular online design community which uses a .net domain extension for their website. It suits them because they wanted to be a network of artists, designers, and companies looking for talent.

Under 4% of all domain names registered are using the .net domain extension.

Why You Might Be Tempted to Use the .Net Extension

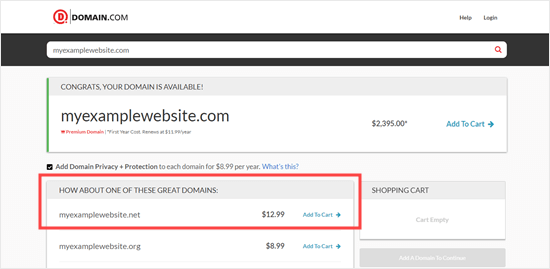

Have you ever tried to register a .com domain and seen something like this?

Domain name registrars often present .net as the top alternative to .com. This might make you think it’s more commonly used than it actually is.

Even the most well-known internet and network service companies use a .com domain name for their business.

Of course, 4% is still a lot of domain names. Over 13 million, in fact. You might wonder who’s using all those .net domain names.

In many cases, the .net domains aren’t really being used.

Many businesses register a .net extension so no-one else can take it. They may not use the .net domain, or they may redirect it to their .com. site.

Also, some companies started with a .net because they couldn’t get the .com they wanted. Most later transferred to a .com domain extension, often keeping the .net domain name registered for technical and legal reasons.

Choosing .Com vs .Net – Which One is Better for SEO?

A lot of our users ask us which domain extension will help them rank higher.

If you’re looking at either .com or .net, it doesn’t make any difference which you choose from an SEO perspective. Search engines will treat both domain extensions the same.

Just focus on SEO best practices and create useful targeted content to rank higher.

The important part is your domain name itself, not the extension.

For example, stargardeningservices.com will rank better than starservices.net because it contains a keyword (gardening services) that people are likely to search for.

How to Buy a Domain Name

There are two ways to get a domain name. You can choose the one that best suits you.

1. Get a FREE Domain Name with Bluehost

To make a website, you need website hosting as well as a domain name.

This may seem a bit confusing when you’re new to creating websites. Make sure you’re clear on the difference between domain name and website hosting.

Usually, you will pay around $14.99/year for a domain name and $7.99/month for hosting. If you are just starting out, then you may feel that’s quite expensive.

Luckily, the folks at Bluehost are offering WPBeginner users a free domain name and a 65% discount on hosting.

→ Click Here to Claim Your Free Domain Name ←

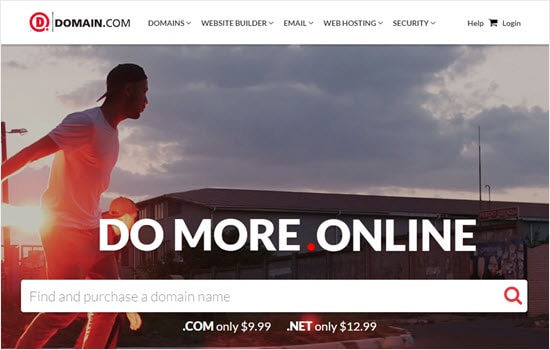

2. Register a Domain Name

If you don’t want to make a website straight away, you can still register a domain name and make a website later.

We recommend using Domain.com for this. They offer features like private registration, easy transfers, easy DNS management, and more. Their search tool shows you premium domains as well as regular ones, too.

To get an exclusive 25% discount on your domain, make sure you go through our link to Domain.com. This will automatically apply our Domain.com coupon code.

If you’re looking for Domain.com alternatives, then please see our list of the best domain registrars.

If this is your first time registering a domain name, then you may want to use our step by step guide on how to register a domain name.

We hope this article helped you learn the difference between .com vs .net domain name extensions. You may also want to see our step by step guides on how to start a blog and how to start an online store.

If you liked this article, then please subscribe to our YouTube Channel for WordPress video tutorials. You can also find us on Twitter and Facebook.

The post Com vs Net – What’s the Difference Between Domain Extensions appeared first on WPBeginner.